The Hong Kong Monetary Authority (HKMA) today (3 November) co-organised Hong Kong FinTech Week 2021, the city’s flagship fintech event, with the InvestHK. The event provides a platform for participants across the globe to share their innovations, experience and insights. Following the announcement of the “Fintech 2025” strategy1 in June, the HKMA announced today two new initiatives to further strengthen Hong Kong’s fintech capabilities:

Green bond tokenisation: The HKMA and the Bank for International Settlements Innovation Hub (BISIH) Hong Kong Centre concluded Project Genesis, which, among others, concept-tested the issuance of tokenised green bonds to retail investors in Hong Kong. Details of the findings were published today on the BISIH website. The HKMA will further look into the feasibility of piloting the issuance of tokenised green bonds under the Government Green Bond Programme.

AML Regtech Lab (AMLab) series: As the next phase to encourage Regtech adoption, the HKMA today announced the launch of AMLab series which will be held on 5 November in collaboration with Cyberport. Five banks will work with data experts using synthetic data for the first time to explore the use of digital footprints and conduct more comprehensive network analysis. AMLab will strengthen banks’ capabilities to protect customers from fraud and financial crime losses.

The HKMA has also made good progress on the initiatives implemented under its “Fintech 2025” strategy, covering areas including data, cross-boundary fintech cooperation, talent development, Central Bank Digital Currency (CBDC) and funding support:

Data: The HKMA has stepped up efforts in facilitating small and medium-sized enterprise (SME) financing using data and successfully completed the Proof-of-Concept study on the technical feasibility of the Commercial Data Interchange (CDI). The CDI will enter the pilot launch stage today involving eight pairs of banks and data providers, and is expected to officially launch by the end of 2022.

Cross-boundary fintech cooperation: Within one week after announcing the “network link-up” between the People’s Bank of China’s Fintech Innovation Regulatory Facility and the HKMA’s Fintech Supervisory Sandbox, around ten banks in Hong Kong have expressed interest to test their cross-boundary fintech initiatives in Hong Kong and Mainland Greater Bay Area cities via the network. About half of these initiatives are related to/can be used in the context of the Cross-boundary Wealth Management Connect.

Talent development: A mentorship network will be introduced under the Industry Project Masters Network (IPMN) for mentors from academia, financial sector, and tech/fintech industry to offer professional expertise and share industry experience with master’s degree students majoring in fintech. The HKMA also entered into Memoranda of Understanding with four local universities to foster collaboration in areas including fintech talent development.

CBDC: Working towards building a multi-CBDC platform for international payments, the HKMA, together with the participating authorities2 and BISIH Hong Kong Centre, published today 15 potential business use cases under the Multiple CBDC Bridge (mBridge) project. In one of the use cases, testing of sample trade settlement transactions across 11 industries and four jurisdictions have commenced on the trial platform and is expected to enter pilot stage from 2022 onwards, with an aim to achieve a system that could support the full process of international trade settlement.

Funding support: To invest in innovations and encourage collaboration between banks and local tech firms, up to HK$1 million of funding support will be provided, under the Innovation and Technology Commission’s Public Sector Trial Scheme (PSTS) via the Fintech Supervisory Sandbox 3.0, for eligible projects in areas such as Regtech and Cybersecurity.

Mr Eddie Yue, Chief Executive of the HKMA, said, “In less than five months after announcing our “Fintech 2025” strategy, the HKMA has made considerable progress on all fronts of the strategy and reached a number of significant milestones. We will continue to double down on our efforts to grasp the opportunities presented by fintech, and strive to build an ecosystem where people across all levels can experience the value and benefits of fintech in their everyday lives.”

Hong Kong Monetary Authority

3 November 2021

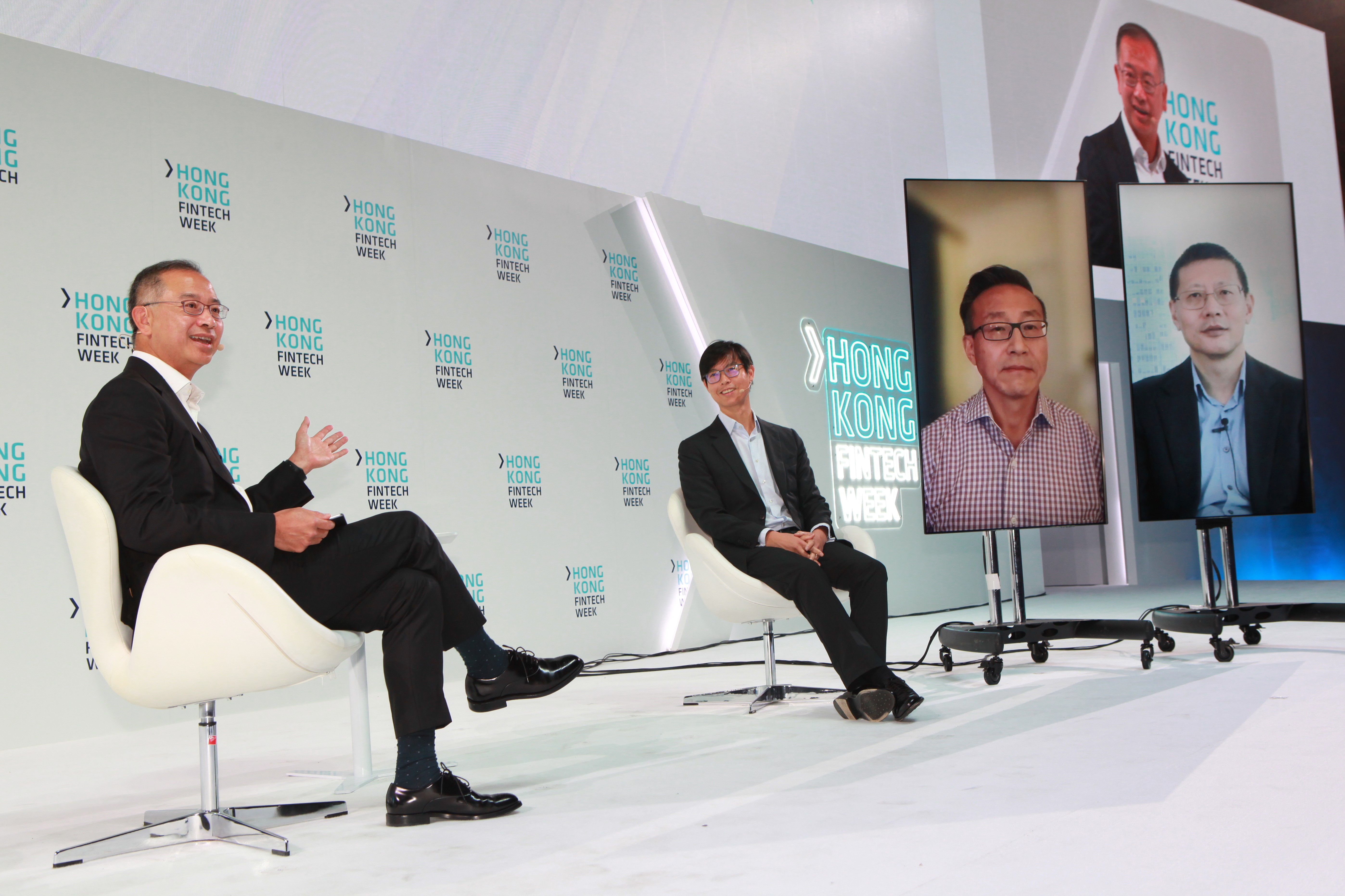

Mr David Liao, Co-Chief Executive, Asia Pacific, HSBC (second from left), Mr Joe Tsai, Co-founder and Executive Vice Chairman, Alibaba Group (second from right), and Mr Neil Shen, Founding and Managing Partner of Sequoia Capital China (first from right), share their views on digital transformation, the future of finance, and leadership in a panel discussion moderated by Mr Eddie Yue, Chief Executive of the Hong Kong Monetary Authority during the Hong Kong FinTech Week 2021.

1Announced in June 2021, the strategy aims to encourage the financial sector to adopt technology comprehensively by 2025, as well as to promote the provision of fair and efficient financial services for the benefit of Hong Kong citizens and the economy. For more information, refer to: https://www.hkma.gov.hk/eng/news-and-media/press-releases/2021/06/20210608-4/.

2They are the Bank of Thailand, the Digital Currency Institute of the People’s Bank of China, and the Central Bank of the United Arab Emirates.

[ad_2]

Source link

Is your business effected by Cyber Crime?

If a cyber crime or cyber attack happens to you, you need to respond quickly. Cyber crime in its several formats such as online identity theft, financial fraud, stalking, bullying, hacking, e-mail fraud, email spoofing, invoice fraud, email scams, banking scam, CEO fraud. Cyber fraud can lead to major disruption and financial disasters.

Digitpol can assist with all stages of cyber related incidents.

Contact Digitpol’s hotlines or respond to us online.

ASIA +85239733884

Europe +31558448040

UK +44 20 8089 9944